Unlock New Revenue Streams with Debt Management

The ultimate guide to help financial advisors mastering debt management in order to attract new clients, earn trust, and open up new revenue streams.

What's Inside

- Tapping into the next generation of clients

- Attracting clients one stage before wealth accumulation

- Empowering clients with debt management and technology

- Unlocking new revenue streams for your advisor firm

- Step by step guide on how to master debt management

What is Optivice?

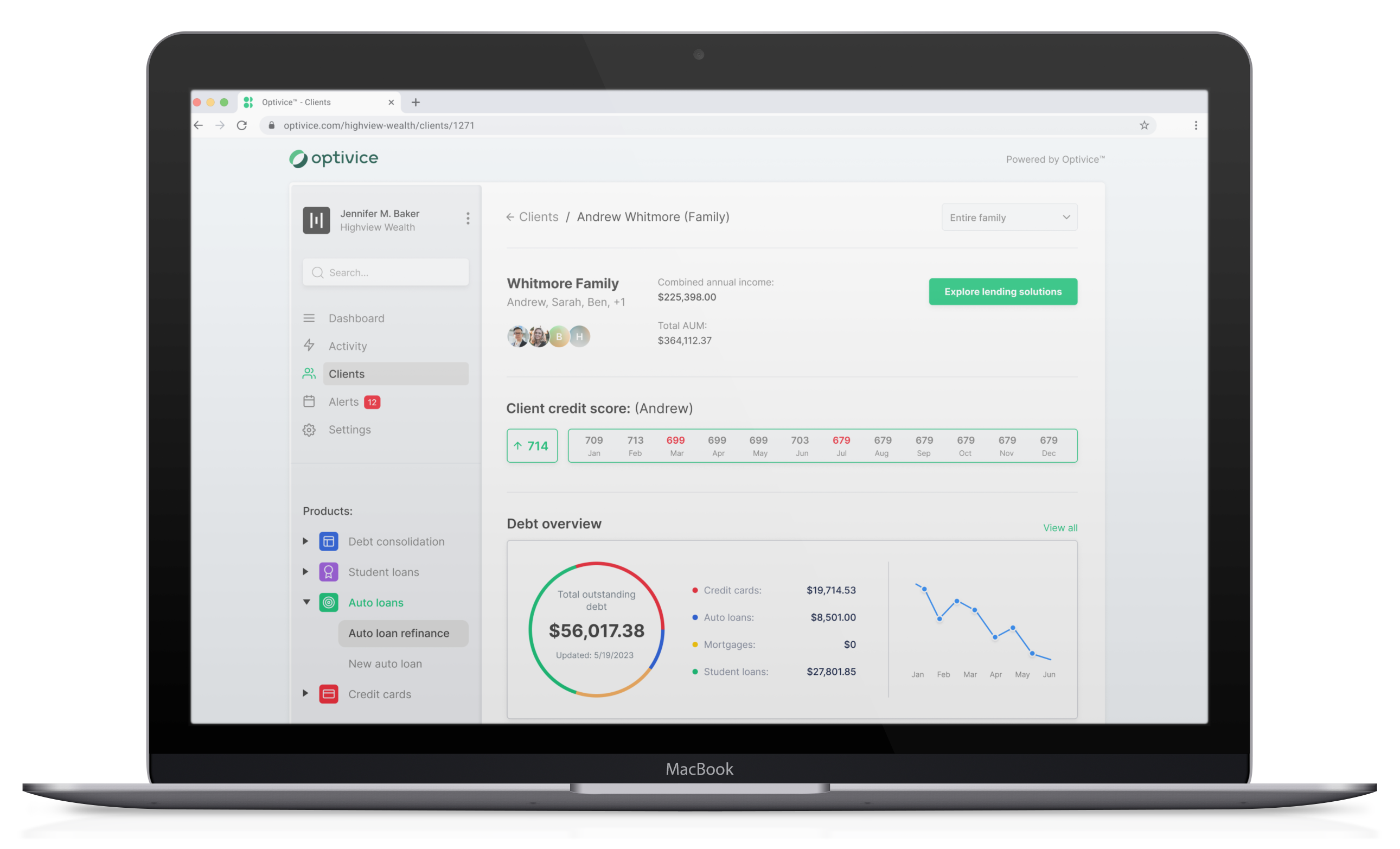

Optivice is a debt management tool for advisors, used for tracking and managing client debt accounts and credit scores.

Optivice empowers you to attract clients at the precise point of taking their wealth-building journey to the next stage. Be the trusted partner that leads them through debt and into wealth, becoming a magnetic force drawing in clients.

As a financial advisor, it’s your fiduciary responsibility to delve into your clients’ outstanding debts. Optivice provides a complete, accurate, and up-to-date view of your clients’ debt data so that you can make informed decisions.

See the full picture and receive important insights on your clients’ debts, loans, and credit scores, making you their trusted advisor who provides a proactive client experience.

The new wave of clients are building their success, and debt is part of their journey. Guide them through debt and credit to gain their trust early on and foster lasting relationships – long into their wealth building days.

Regardless if you’re a flat fee or AUM-based advisor, integrating debt management services into your offerings provides additional revenue streams.