Optivice empowers you to attract clients at the precise point of taking their wealth-building journey to the next stage. Be the trusted partner that leads them through debt and into wealth, becoming a magnetic force drawing in clients.

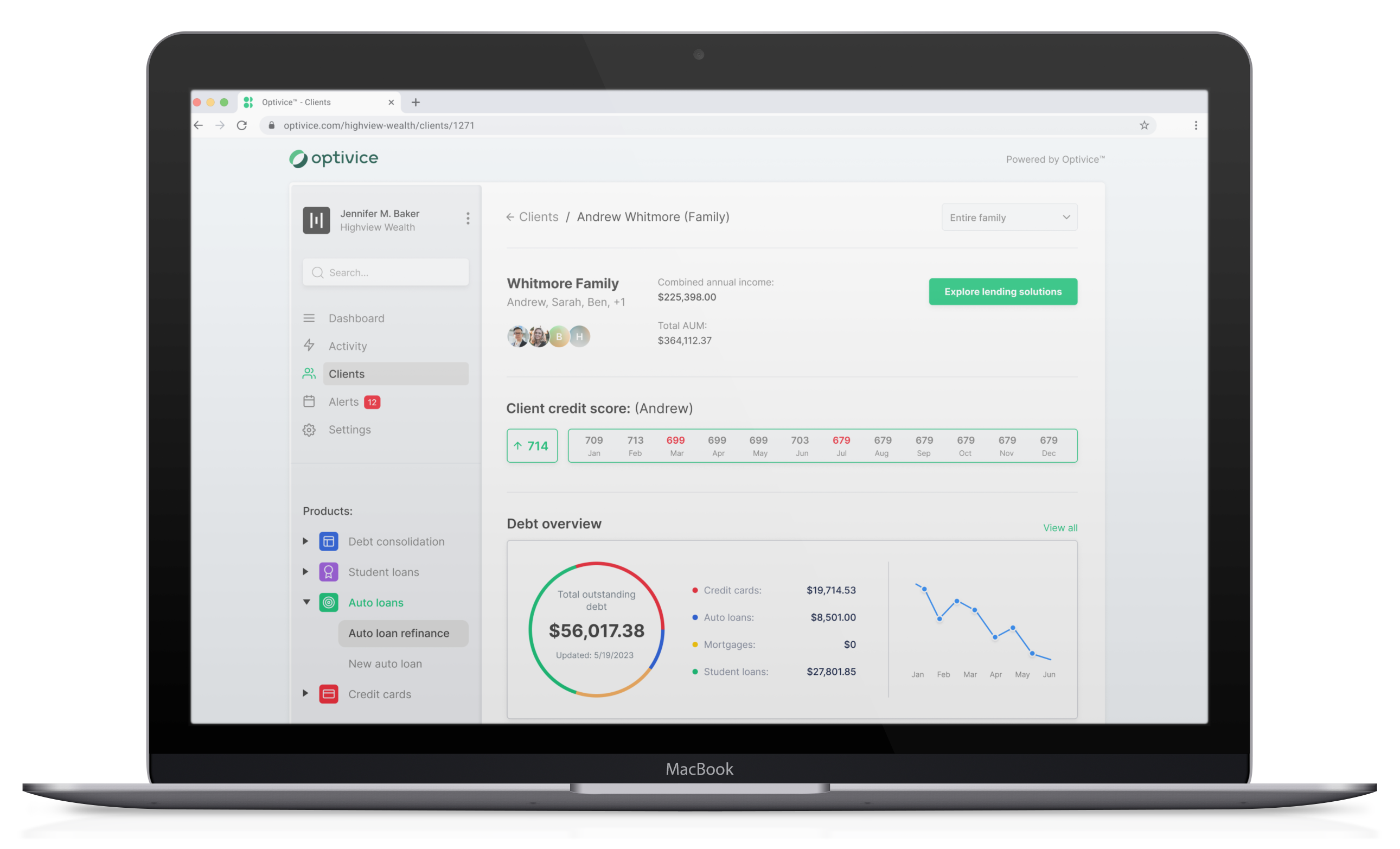

As a financial advisor, it’s your fiduciary responsibility to delve into your clients’ outstanding debts. Optivice provides a complete, accurate, and up-to-date view of your clients’ debt data so that you can make informed decisions.

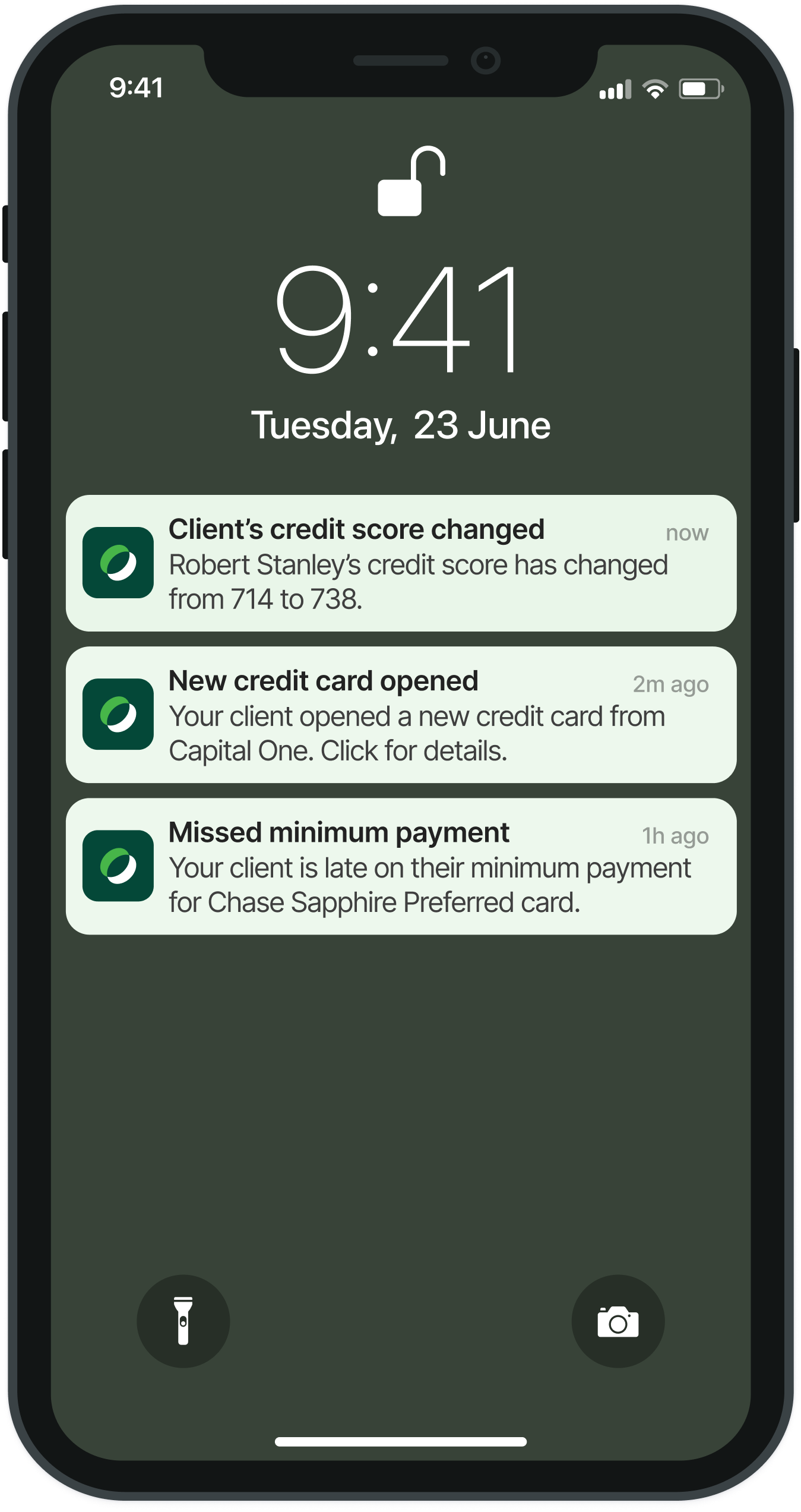

See the full picture and receive important insights on your clients’ debts, loans, and credit scores, making you their trusted advisor who provides a proactive client experience.

The new wave of clients are building their success, and debt is part of their journey. Guide them through debt and credit to gain their trust early on and foster lasting relationships – long into their wealth building days.

Regardless if you’re a flat fee or AUM-based advisor, integrating debt management services into your offerings provides additional revenue streams.

Optivice is a debt management tool built for advisors, allowing them to boost their value proposition by integrating debt planning and management solutions for their clients.

Optivice

1330 6th Ave

New York, NY 10019

info@optivice.com

929-292-8286

Optivice is a debt management tool built for advisors, allowing them to boost their value proposition by integrating debt planning and management solutions for their clients.

Optivice

1330 6th Ave

New York, NY 10019

info@optivice.com

929-292-8286