Your employees are stressed  about finances

about finances

We're here to change that with the employee benefit  that makes a difference.

that makes a difference.

Nearly one in two U.S. employees are worried about money, leading to depression, panic attacks, and distractions at work. Provide an employee benefit that eases financial stress so that everyone can stay focused and productive at work.

Your employees are stressed  about finances.

about finances.

We're here to change that with the employee benefit  that makes a difference.

that makes a difference.

Nearly one in two U.S. employees are worried about money, leading to depression, panic attacks, and distractions at work. Provide an employee benefit that eases financial stress so that everyone can stay focused and productive at work.

Finances are a major cause of stress for your employees, and ignoring this issue is costing you.

$500 Billion

The annual cost to businesses due to employee's financial stress

1 month

Amount of productive work financially stressed employees lose per year

2.2X

More likely to seek a new job opportunity due to financial stress

.

"I'm forever grateful to my company for connecting me with Optivice to help me reduce my debt! My focus has improved dramatically as I can now use my mind on productive thoughts rather than stressing out about my credit cards."

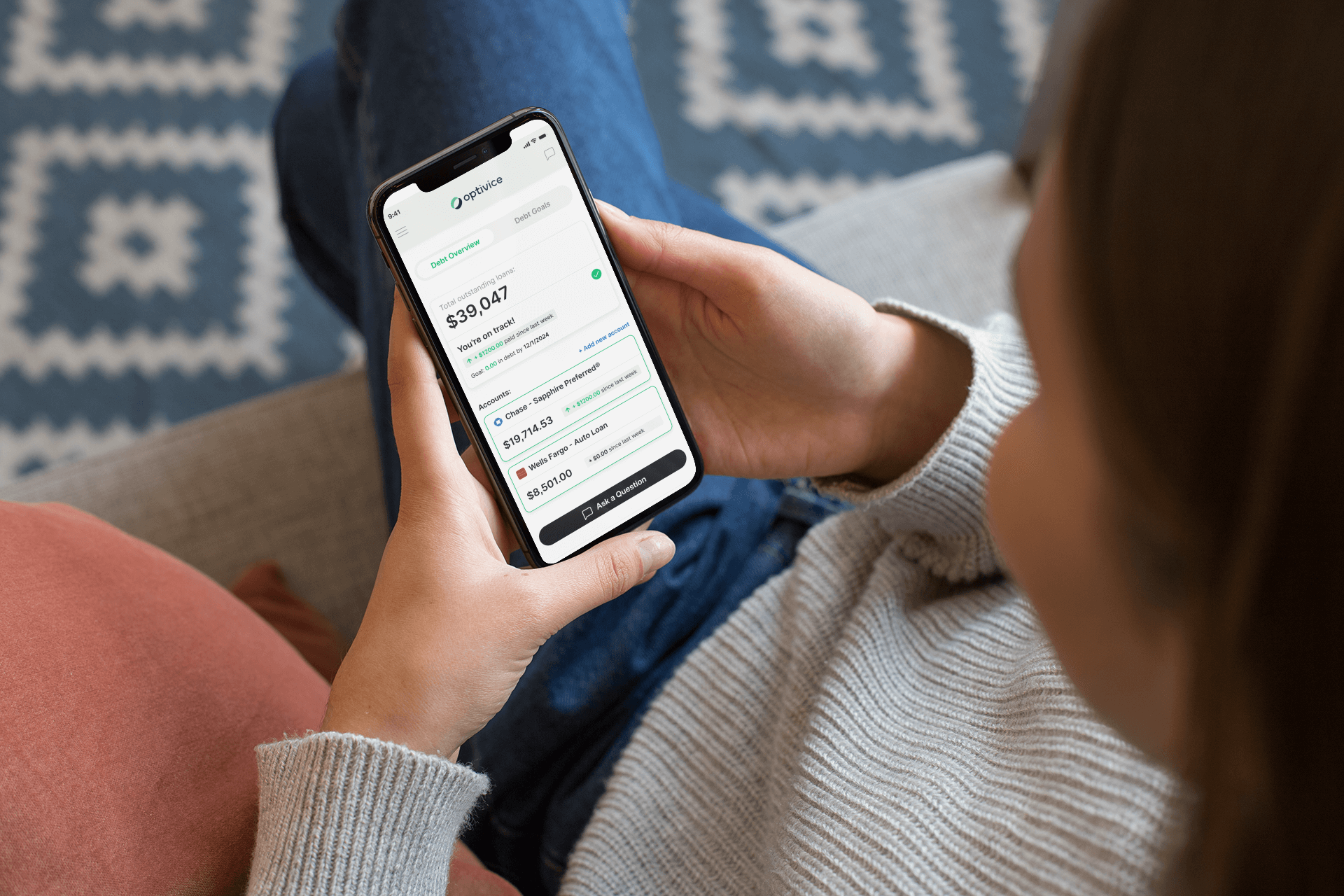

Our all-in-one credit score and debt management solution

Improve financial wellness for your employees in an efficient and tangible way to help improve their lives, increase their focus, and strengthen the workplace culture.

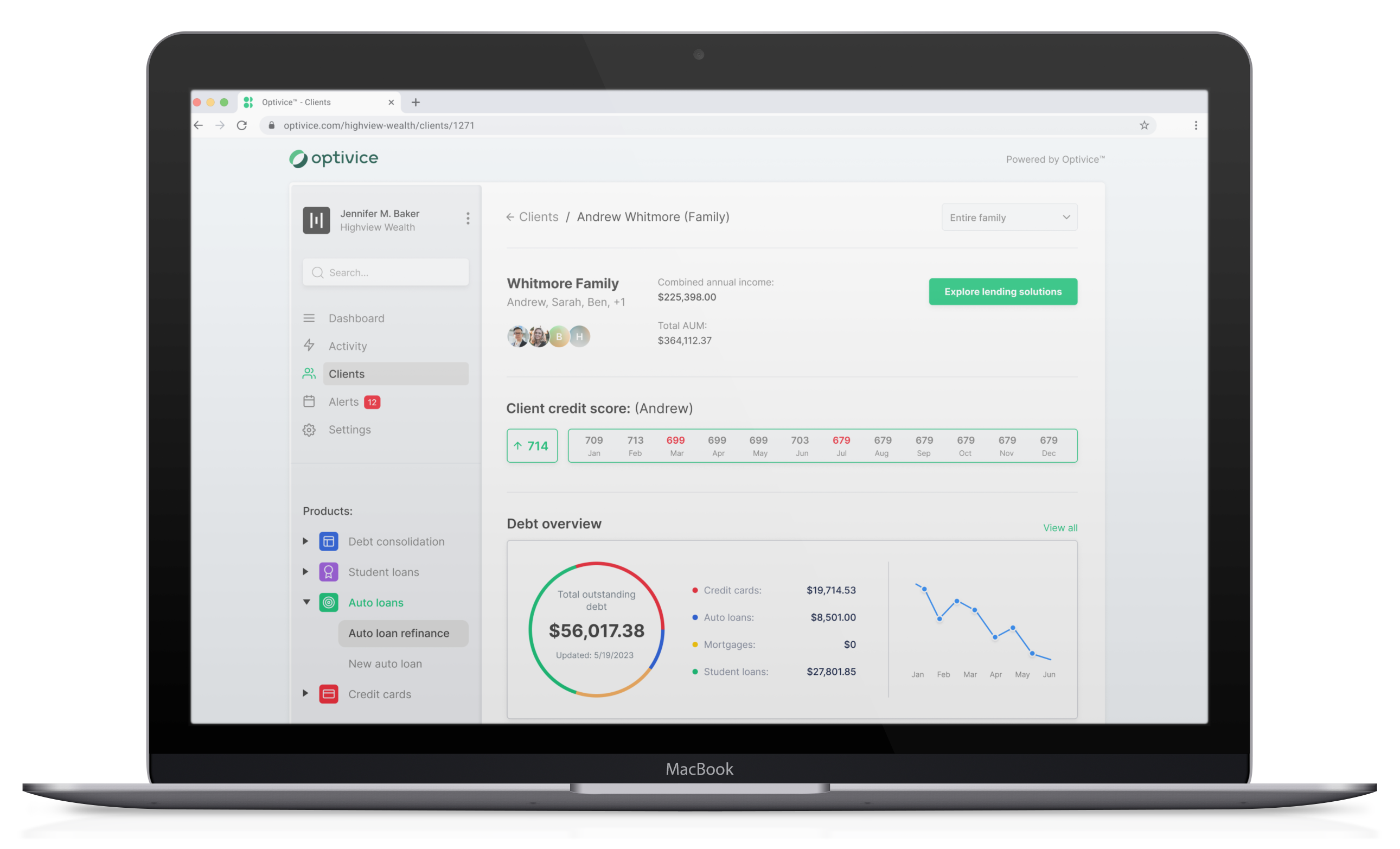

1:1 coaching from financial and debt relief experts

Our coaches will dive deep with a view into their outstanding debt details, across credit cards, auto loans, mortgages, student loans, and more.

Financial goal tracking and debt repayment progress

We'll help them set and track debt repayment goals, which will help them stay on top of their goals with automated alerts.

Ongoing personalized Recommendations

Improve their lives while creating a happier work environment with employees carrying less debt-related stress.

Why Optivice?

While many employers offer health and wellness benefits, they often overlook a crucial aspect of well-being: financial wellness. Financial stress is the leading cause of anxiety among Americans, leading to decreased employee productivity and a lack of focus. Optivice not only enhances the overall well-being of your workforce but also positively impacts your company's bottom line.

Financial stress increases the likelihood of employees seeking new jobs by 2.2X. Optivice improves employee financial wellness, leading to higher retention rates as employees feel supported and no longer need to stress about finances.

Financially stressed employees lose nearly one month of productive work days per year. By prioritizing employee financial wellness through Optivice, companies can not only reduce these losses but also see a significant increase in productivity.

Financially stressed employees are 4X more likely to suffer from depression and about 5X more likely to have lower work quality. Optivice’s focus on employee financial wellness significantly improves overall well-being, enhancing the quality of both employee’s lives and work performance.

Financially stressed employees are 4.5 times more likely to have poor relationships with colleagues, negatively impacting the company culture. Optivice helps reduce financial stress among employees which helps foster a positive workplace and better relationships among team members.

Lost productivity, turnover, and other factors related to poor financial wellness cost the average company between 11-14% of their total payroll expense. By prioritizing employee financial wellness through Optivice, companies can significantly reduce these costs.

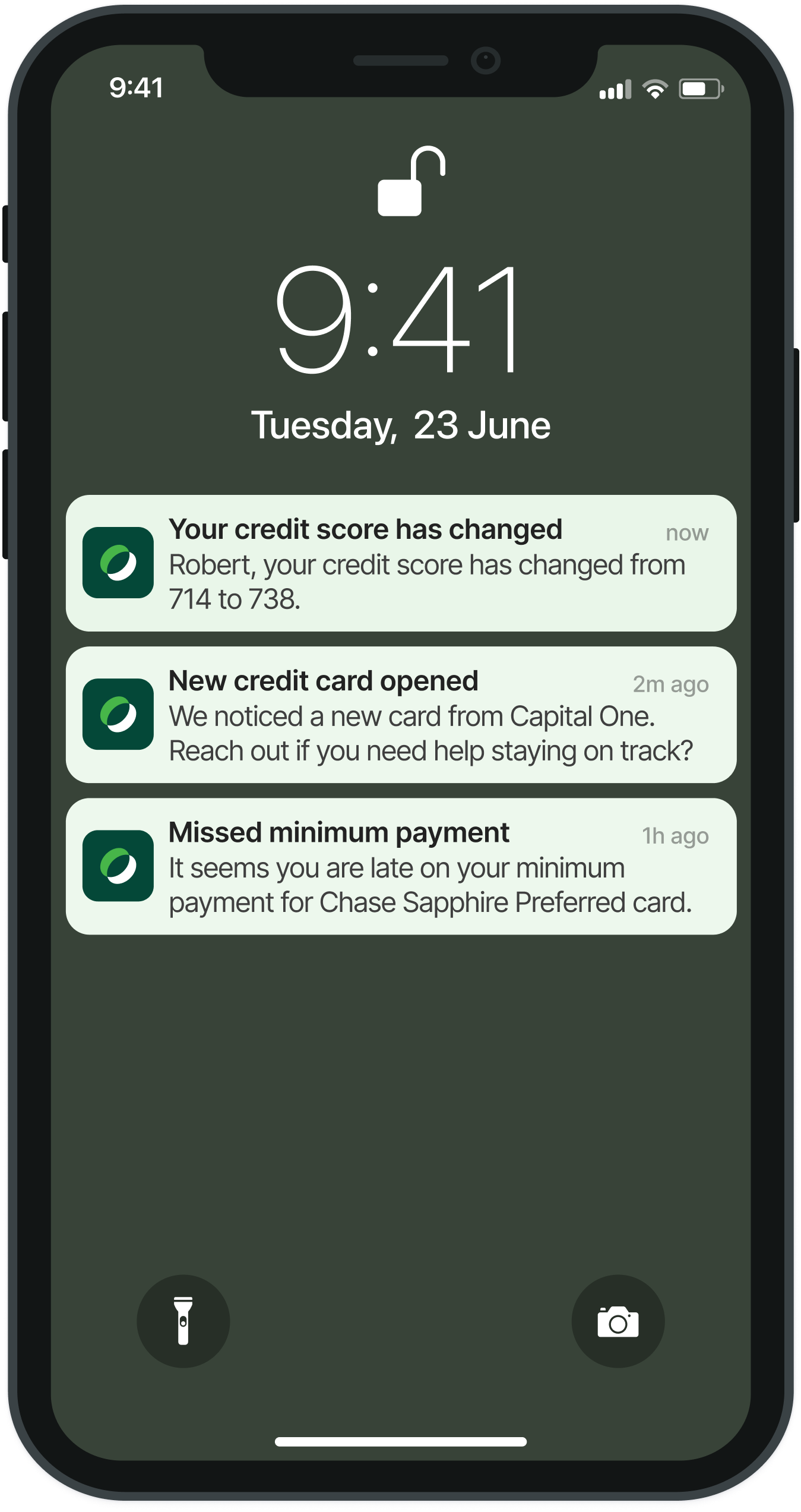

Proactive notifications for financial well-being

Get happier and more productive employees who stay with you long-term as a result of improved financial well-being.

Personalized Recommendations

Employees receive proactive notifications and tips tailored to their unique financial goals.

Timely Insights

Employees receive real-time updates on changes that impact their financial goals and credit scores.

Optivice is a debt management tool built for advisors, allowing them to boost their value proposition by integrating debt planning and management solutions for their clients.

Optivice

1330 6th Ave

New York, NY 10019

info@optivice.com

929-292-8286

© Copyright Optivice 2023

Optivice is a debt management tool built for advisors, allowing them to boost their value proposition by integrating debt planning and management solutions for their clients.

Optivice

1330 6th Ave

New York, NY 10019

info@optivice.com

929-292-8286