As a financial advisor, your role extends beyond mere number crunching and investment recommendations. One critical aspect of your responsibility is to provide debt management and debt reduction strategies to guide your clients through the maze of debts, student loans and mortgages they may find themselves entangled in. Debt management isn’t just about debt reduction; it’s about crafting a holistic strategy that empowers your clients to take control of their finances. In this blog post, we’ll delve into five debt management strategies that can make a substantial impact on your clients’ financial well-being and increase your value as a financial advisor.

Table of Contents

1. Analyze Debt Holistically

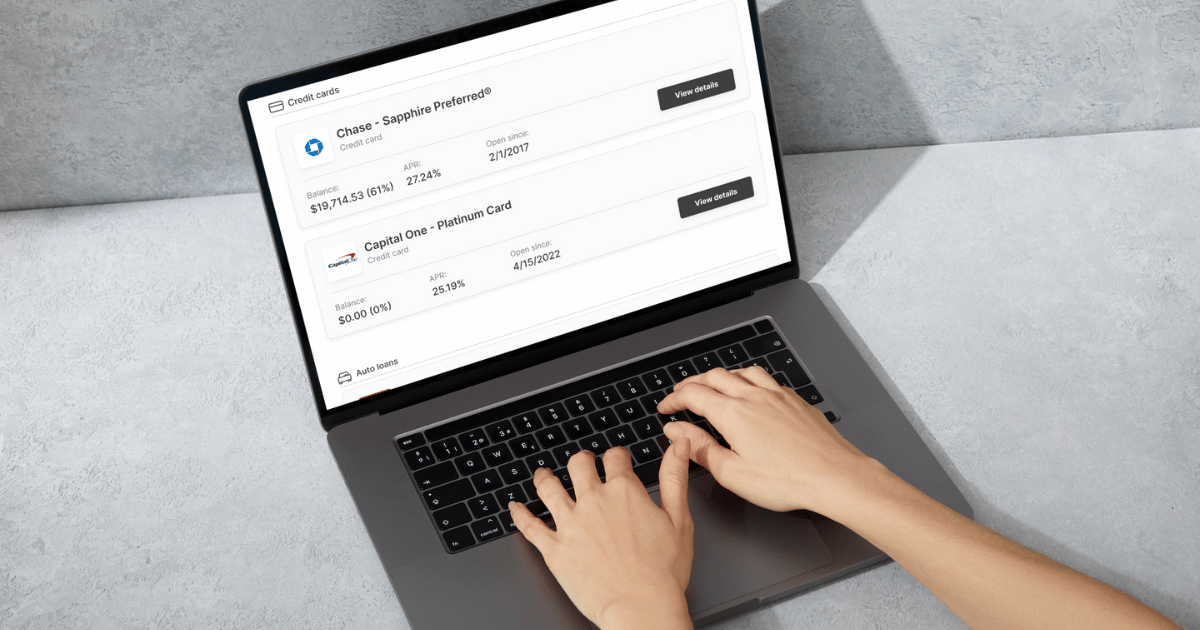

A foundational step in effective debt management is gaining a comprehensive understanding of your clients’ debt portfolios. This entails more than just knowing the outstanding balances; it involves getting a complete and up-to-date overview across all debt and diving deep into the specifics.

Consider what the interest rates are attached to each debt. What are the terms and payment structures? How much of their credit card are they paying off each month? By analyzing debts holistically, you can prioritize which debts to reduce first, whether it’s the high-interest credit card debt or the low-interest student loan, or if you should consolidate debt.

Photo credit: Investopedia/Nez Riaz[/caption]

Photo credit: Investopedia/Nez Riaz[/caption]

2. Tailored Debt Reduction Strategies

Cookie-cutter approaches rarely yield optimal results in the complex realm of personal finance. The snowball and avalanche methods are two popular debt reduction strategies, but to truly empower your clients, craft personalized debt repayment plans that align with their unique financial goals.

Firstly, we recommend that you consider their income, expenses, goals, risk tolerance, and life circumstances. Your goal is to optimize cash flow while minimizing interest costs. A well-designed repayment plan not only accelerates debt reduction but also ensures that your clients remain on track with their overall financial objectives.

3. Effective Communication

A strong client-advisor relationship is built on trust, and that trust is bolstered by effective communication. Debt can be a sensitive topic, often laced with emotions like shame or anxiety. Foster a safe environment where your clients feel comfortable discussing their debt challenges openly.

By having honest non-judgemental conversations about debt management strategies and their financial well-being, you can provide guidance to help clients feel empowered to start managing and reducing their debt effectively.

4. Monitor Debt Reduction Progress

In the journey toward financial freedom, progress tracking serves as both a compass and a motivator. Regularly monitor your clients’ debt reduction progress to both ensure that their debt doesn’t slip through the cracks and to celebrate achievements along the way.

These milestones can be significant debt payoffs, improved debt-to-income ratios, or enhanced credit scores. By acknowledging and celebrating these achievements, you’re not only motivating your clients to stay committed but also reinforcing the positive impact of their efforts.

5. Credit Score Optimization

A strong credit score opens doors to better financial opportunities, from favorable loan terms to lower insurance premiums. Empower your clients by guiding them on improving their credit scores. This might involve educating them on responsible credit utilization, the importance of timely payments, and the need to monitor for changes in credit scores. Above all, elevating their credit scores can significantly enhance their financial flexibility and choices.

Takeaway

In conclusion, by implementing these five debt management strategies, you can empower your clients to navigate their financial journey with confidence and determination. Analyzing debt holistically, crafting tailored reduction strategies, fostering effective communication, monitoring progress, and optimizing credit scores are all vital components of a comprehensive approach to debt management. As you guide your clients toward financial freedom, you’re not just addressing debts – you’re shaping their financial future.

Want to provide debt management to your clients?

Book a demo to learn how Optivice can enhance your firm’s value with the first-ever debt management solution built for advisors.