As a financial advisor, it’s essential to guide your clients on the path to improving their credit scores. A credit score is a crucial financial indicator that can influence a client’s ability to secure loans, obtain favorable interest rates, and even impact their job prospects. In this comprehensive guide, we’ll delve into actionable strategies that you can use as a financial advisor to help your clients improve their credit scores.

What is a good credit score?

Credit scores typically fall within a range of 300 to 850. While the specific ranges can vary based on the credit scoring model, as a general guideline, credit scores from 580 to 669 are classified as fair; scores from 670 to 739 are considered good; scores from 740 to 799 are labeled very good; and scores of 800 and above are recognized as excellent.

How to Improve Credit Score

1. Pay Bills on Time

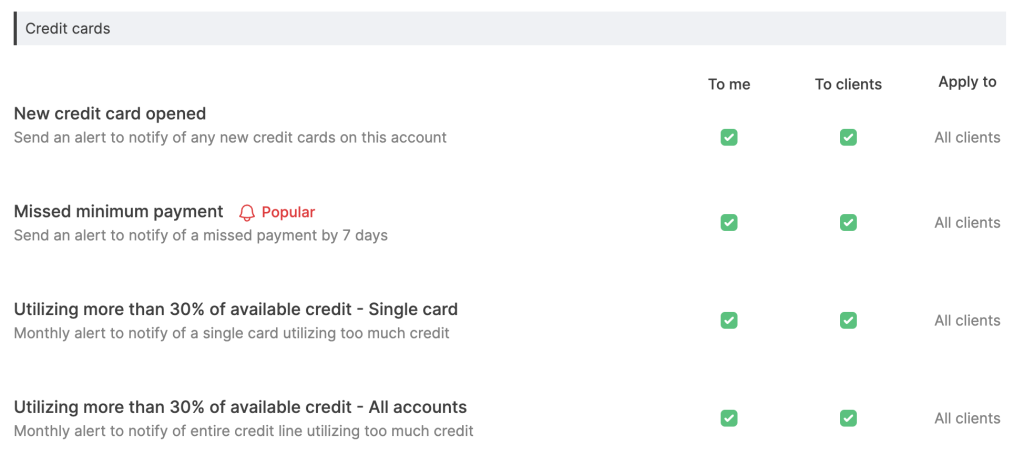

One of the most effective ways to elevate your clients’ credit scores is by making sure that they are consistently paying their bills on time. Timely payments on credit cards, loans, and other accounts demonstrate responsible financial behavior and establish a positive credit history. On the flip side, late or missed payments can significantly harm your clients’ credit scores. Optivice can notify you if your clients miss their fees so that you can step in and help them get back on track.

2. Don’t Use More Than 30% of Credit

Maintaining low credit card balances is another key factor in helping boost credit scores. This showcases disciplined credit management and can significantly improve your client’s score over time.

Aim to help client’s keep their credit card utilization below 30% of their credit limit because anything over may be interpreted as a red flag to lenders. You can set up notifications in Optivice so that you and your clients are aware when over 30% of their credit is being utilized.

3. Diversify Your Credit Mix

Having a variety of credit types, such as credit cards, personal loans, and mortgages, can showcase your ability to handle different financial obligations responsibly. Successfully maintaining a diverse mix of types of credit may positively impact your credit score but this does not mean that clients should open credit accounts they don’t need. Optivice allows you to see each client’s credit mix on one visual dashboard so that it’s easy to track.

4. Exercise Caution with New Accounts

While opening new credit accounts can offer benefits, it’s crucial to be mindful of how they impact your client’s credit score. Frequent account openings can lower the average account age and potentially harm your client’s score. Prioritize quality over quantity when seeking new credit. You can be proactive by setting up notifications in Optivice to get alerted anytime a client opens up a new credit card.

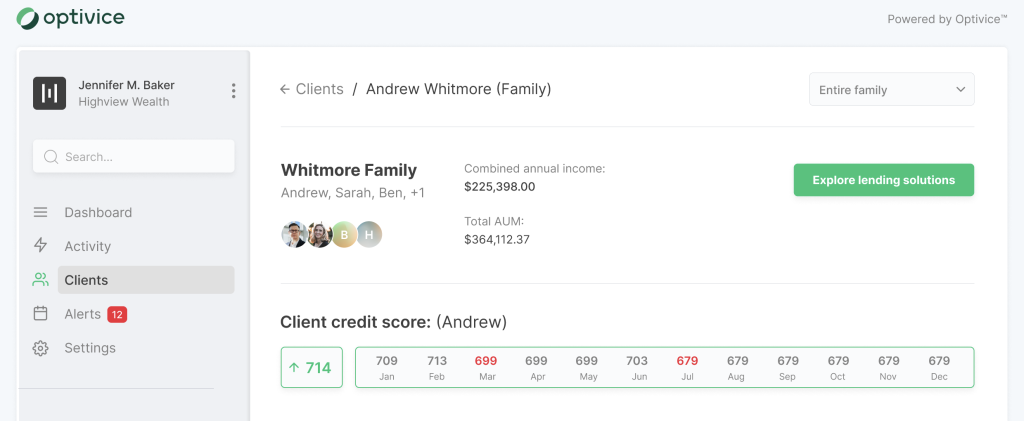

5. Regularly Monitor Credit Score

Monitor client credit scores regularly to stay on top of changes and to identify any errors or inaccuracies. Disputing and correcting these issues can prevent unwarranted negative impacts on their credit scores. Optivice tracks clients’ credit scores for you as well as monthly changes and sends the information back to your CRM so that it’s always front and center. Optivice will also prompt you with beneficial ways that you can help improve credit score for certain clients.

6. Maintain a Long Credit History

The length of credit history plays a significant role in credit score. Advise clients to keep older accounts open, even if they’re not actively using them, to ensure that the date of their oldest account being opened is not recent. A longer credit history reflects a more comprehensive track record of responsible credit management. In Optivice, you can easily look at the client dashboard to see how long they have had each account open.

7. Minimize Credit Inquiries

Applying for new credit leads to hard inquiries, which can temporarily lower a client’s credit score. Lenders also use inquiries to track how much credit you’re applying for in a 12-month period. Once you have too many during that time, typically six, they will deny you for having too many inquiries in the last 12 months.

Guide your clients to be strategic about when and where they apply for credit to minimize the impact on their credit scores. Optivice’s software allows you to search and prequalify for credit for clients without negatively impacting their credit scores.

8. Leverage Authorized User Status

If a client has access to a partner or family member’s well-managed credit account, becoming an authorized user on that account can positively influence their credit score. This strategy is particularly useful for those looking to establish or rebuild credit. Cardholders’ and authorized users’ payments – whether on time, late, or missed – will be added to both parties’ credit reports, so it’s important that both cardholders and authorized users are reliable.

9. Negotiate with Creditors

Financial difficulties can arise unexpectedly. As a financial advisor, recommend that your clients communicate with their creditors if they’re facing challenges in meeting their financial obligations. Negotiating better terms or payment plans can help mitigate negative credit consequences.

10. Cultivate Responsible Credit Behavior

Ultimately, emphasize the importance of consistent, responsible credit behavior. Encourage your clients to prioritize smart credit decisions, responsible borrowing, and prudent financial management to gradually improve their credit scores. You can turn on notifications in Optivice for either yourself, as the advisor, or for yourself and your clients to make sure that no credit score issues go unnoticed.

Takeaway for How to Help Improve Clients’ Credit Scores

By implementing these actionable strategies to improve your clients’ credit scores, you can guide them to take control of their credit health, secure better financial opportunities, and pave the way for a brighter financial future. Remember to make use of Optivice to automatically track client’s credit score and changes as well as to receive proactive notifications of tangible advice you can give to your clients to help improve their credit scores. Each individual’s financial journey is unique, so tailor your advice to suit your client’s specific circumstances and goals.