1. Enhance Your Relationships with Clients

Building trust and strong relationships are crucial in the advisory profession. Financial advisors who actively assist clients in overcoming financial challenges and celebrate their progress are not just advisors; they are trusted allies. Every client interaction becomes an opportunity to solidify the advisor-client relationship. Through the lens of debt management, financial advisors play a more comprehensive role, one that extends beyond the bare bones of financial planning.

Through offering debt management services, advisors can showcase their dedication to their clients’ financial well-being in a tangible and impactful manner. This commitment resonates deeply with clients, as it directly addresses one of the most pressing financial concerns — debt. In essence, debt management is a key factor for allowing clients to see their advisor as someone who not just manages their finances, but who cares about their financial well-being, resulting in a strong client-advisor relationship.

2. Increase Clients’ Savings and Investments

Mastering effective debt management and reduction strategies serves as the gateway to liberating clients’ disposable income. Financial advisors who guide their clients in reducing or consolidating high-interest debts and offer a well-structured repayment plan perform an invaluable service. They not only ease the burden of debt but also pave the way for clients to embrace new opportunities for increased savings and investments.

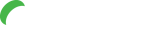

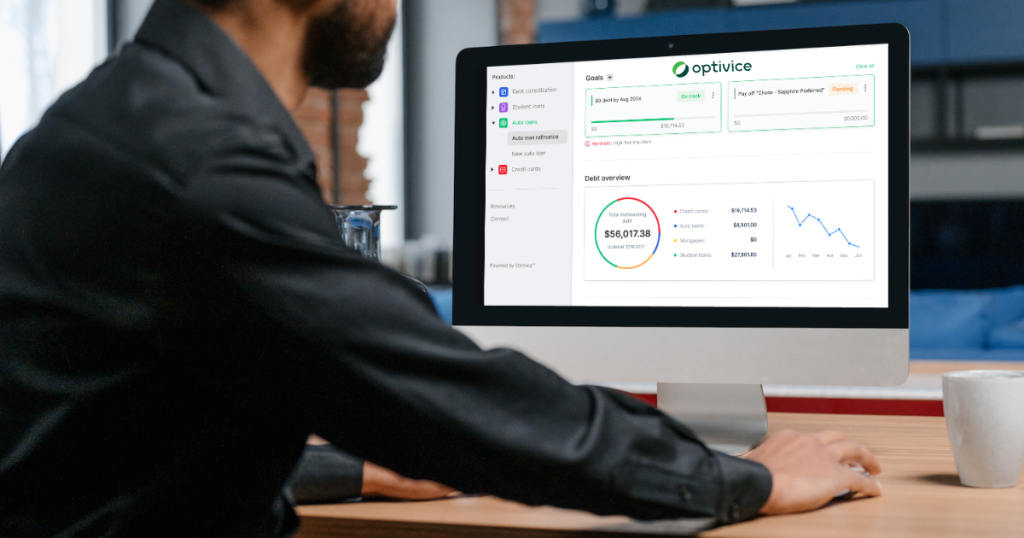

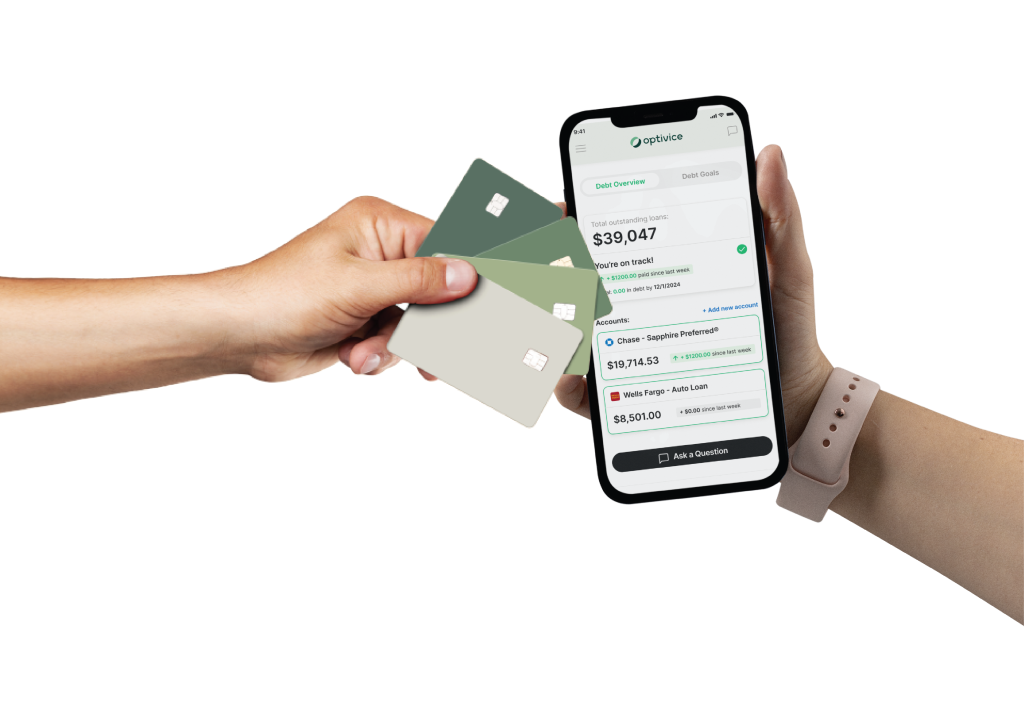

As the weight of debt gradually diminishes, clients find themselves with more financial resources. Financial advisors play a pivotal role in guiding clients to make the most of this windfall. They help clients channel the funds that were once earmarked for debt toward building up their emergency savings, bolstering retirement accounts, or venturing into a diverse array of investment opportunities. This transformation from debt servitude to financial freedom is a remarkable journey, and with the assistance of Optivice’s cutting-edge debt management solution, advisors can take it a step further.

Optivice’s innovative tool provides advisors with the means to visually demonstrate to clients how their debt reduction efforts positively impact their savings and investments. Through compelling visualizations, advisors create a tangible connection between debt management and wealth accumulation.

3. Provide Truly Holistic Financial Planning

In a financial landscape where 80% of adult Americans carry some form of debt, it is evident that debt management is not just an option but an integral part of any comprehensive financial plan. For financial advisors, offering debt management services empowers them to take a more holistic approach to their clients’ financial well-being. By understanding their client’s complete financial picture, going beyond just assets and income, advisors can craft personalized strategies that align with their client’s unique goals and financial circumstances.

Remarkably, despite its foundational significance in financial planning, many advisors have refrained from actively promoting debt management services. The primary reason for this reluctance stemmed from the lack of effective tools to aid in the efficient management of their clients’ debt—until recently.

However, as the financial advisory landscape continues to evolve, innovative solutions such as the Optivice debt management tool have emerged, offering advisors the capability to navigate this critical terrain effectively. These tools empower advisors to offer comprehensive debt management services, transforming what was once an overlooked aspect into a dynamic asset within their service portfolio.

Learn more about debt reduction strategies to empower your clients’ financial journeys.

4. Boost Client Retention and Referrals

Financial advisors who offer comprehensive debt management services that positively impact their clients’ financial well-being, foster a sense of loyalty and trust. When clients can clearly see the impact that their advisor is making on their financial lives, they are more likely to view their advisor as an invaluable partner in their financial journey. This heightened satisfaction and trust not only makes clients more inclined to stay with their advisor long-term, but also leads to a steady stream of referrals.

Clients who perceive their advisors as trustworthy are not only more satisfied with their services but also more likely to entrust them with a broader spectrum of financial matters. Therefore, once you gain clients trust by helping them manage debt, the decision to trust you with their savings, wealth building, and investments is seamless. They recognize that the same dedication and expertise that helped them tackle their debt challenges will be harnessed to build and protect their wealth.

5. Empower Clients Through Financial Literacy

Educating clients on debt management, offering viable solutions, and fostering financial literacy is a critical component of the services offered by financial advisors. By empowering clients with the knowledge and tools needed to understand and manage their debts effectively, advisors can create a more informed and financially responsible Americans.

Data from a survey by the National Endowment for Financial Education (NEFE) highlights the urgent need for financial education, with 75% of people saying that spending and budgeting is the most important topic they wish they learned, followed by managing credit (55%). With the lack of the educational system’s focus on finances, financial advisors can step into the arena by teaching valuable knowledge about debt management strategies, credit scores, and budgeting techniques. By doing so, they enable clients to not only grasp the intricacies of their finances but also to develop practical skills for debt reduction and financial stability. As a result, advisors are instrumental in transforming their clients into financially literate individuals who are better equipped to make informed decisions, overcome debt challenges, and work towards achieving their financial aspirations.

6. Minimize Client Stress and Anxiety

In today’s fast-paced and financially demanding world, many individuals grapple with the weight of financial stress, and a significant portion of this stress stems from debt-related concerns. Studies reveal that among those who report money negatively impacting their mental health, a staggering 48% say that debt is their top reason for anxiety. As a financial advisor providing effective debt management strategies, you can alleviate this burden for your clients and offer peace of mind.

By helping your clients manage debt effectively, you are making a positive impact on their mental well-being. Together with your clients, you can establish clear and achievable debt repayment goals tailored to their financial circumstances and objectives. By setting these goals, you not only provide a structured roadmap for debt management but also give your clients a sense of control over their financial destiny, reducing the anxiety associated with uncertainty.

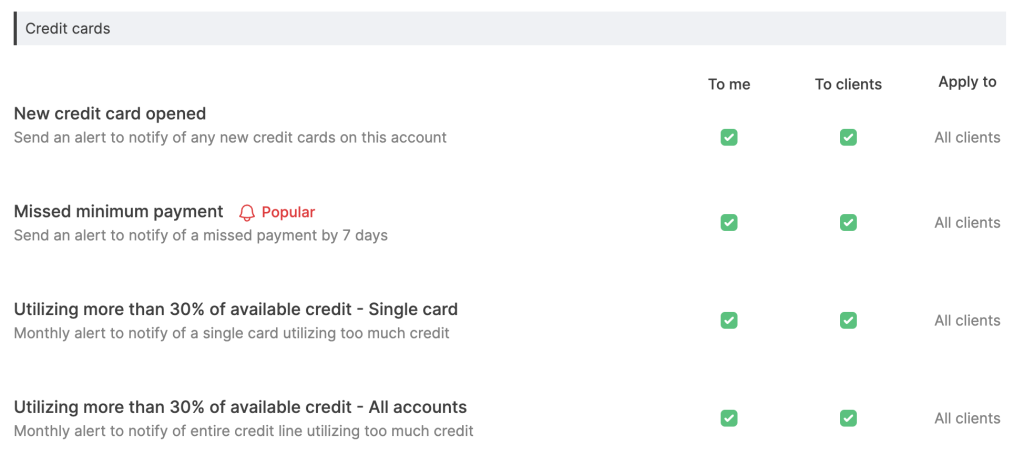

Timely notifications from tools like Optivice, with insights into your clients debt and goal progress, allow you to intervene promptly and guide your clients back on track. By offering these comprehensive debt management services, you don’t just minimize stress and anxiety; you provide a lifeline to individuals seeking relief from the weight of financial burdens.

7. Accelerate Financial Progress

Debt management strategies, such as setting and tracking repayment goals and debt consolidation or refinancing, are valuable tools advisors can use to assist clients in achieving their financial goals. These strategies can lead to lower interest rates and reduced monthly payments to free up more funds for savings and investments. The ability to manage existing debts and optimize cash flow allows clients to take on new opportunities without becoming burdened by excessive financial stress.

Debt can also serve as a valuable tool in accelerating financial progress when used strategically. For instance, low-interest debt, like a mortgage or a well-structured business loan, allows clients to invest in assets that can appreciate in value over time. Owning a home, for example, often results in long-term wealth accumulation as property values tend to increase. Entrepreneurs also rely on loans to kickstart or expand their businesses, potentially leading to higher income and overall wealth. Furthermore, responsible debt management, including timely repayments, helps clients build a positive credit history. A strong credit profile opens doors to better loan terms, lower interest rates, and improved access to financial opportunities, such as securing a favorable mortgage or credit card terms.

8. Prove your Value to Clients

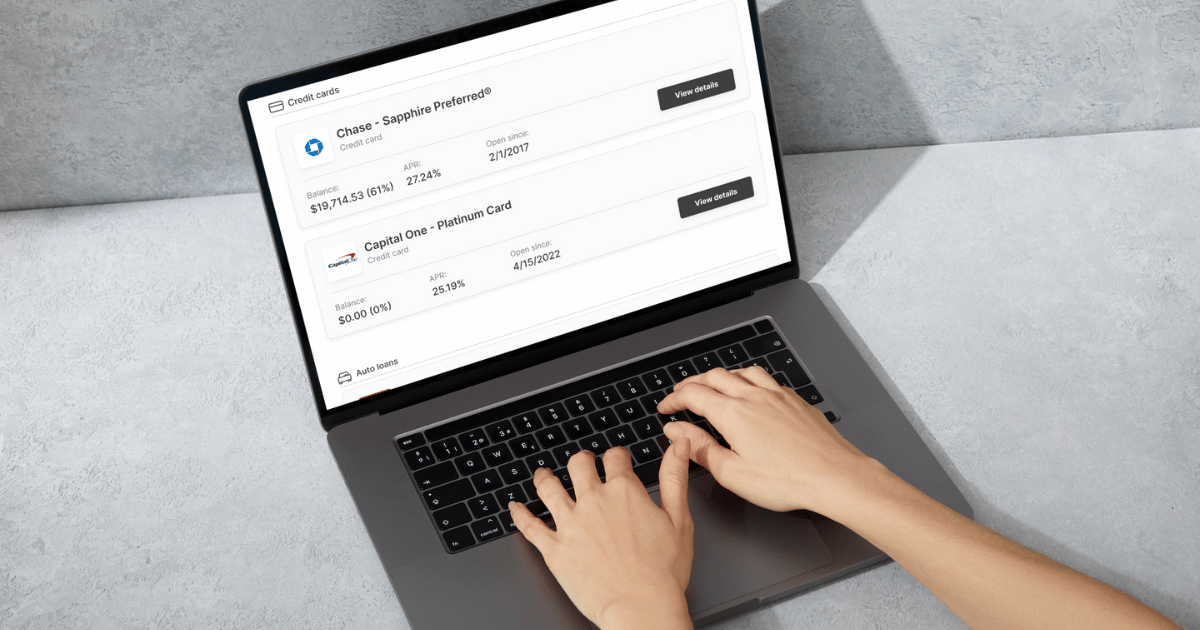

As a financial advisor, you can effectively showcase your value by optimizing debt management strategies for your clients. Begin by analyzing their debt portfolio, taking into consideration factors such as interest rates, repayment terms, and their overarching financial objectives. By conducting this thorough assessment, and utilizing tools like Optivice, you can pinpoint opportunities to reduce interest costs, consolidate high-interest debts, or explore refinancing options, resulting in significant long-term savings that directly enhance their financial well-being.

Moreover, when advisors visually track and demonstrate clients’ progress towards their debt repayment goals, it motivates and encourages clients to stay committed to their debt management plan. Advisors can highlight their value by illustrating the total amount clients save through strategic debt management, emphasizing the tangible financial impact on their clients’ financial stability. In addition, advisors can effectively convey how reducing debt burdens creates avenues for increased savings, investments, and wealth accumulation, aligning with their clients’ aspirations, be it securing a comfortable retirement, buying a home, or funding a child’s education.

Learn more about how to increase your value as a financial advisor.

9. Improve Budgeting and Cashflow

By analyzing income, expenses, and outstanding debts, advisors help clients develop a well-structured budget. This approach ensures timely debt repayments without compromising other financial commitments. By prioritizing high-interest debts, consolidating debt, and identifying areas for potential savings, advisors can assist clients’ journey to debt freedom and increased cash flow.

The Federal Reserve’s research shows that a significant portion of American households struggle with debt, but those with well-defined repayment strategies are more likely to make progress in reducing their outstanding balances. This is where an advisor can step in and help clients identify areas for potential savings by conducting a comprehensive debt analysis. By uncovering opportunities for paying down debt more effectively, advisors not only accelerate the journey to debt freedom but also boost cash flow for other financial goals, such as savings and investments.

10. Gain a Competitive Advantage

In a crowded marketing filled with financial advisors, the ability to provide debt management services is a game-changer. It allows you to distinguish your practice by offering a crucial element of financial stability to clients who are often overlooked because they are in the earlier stages of wealth building. Recognizing that debt is often a natural part of life, especially in the initial stages of financial growth, you empower your clients by proactively addressing debt-related challenges. This proactive approach grants you a unique advantage in attracting potential clients before your competitors can.

By addressing debt head-on, you provide a substantial influence over your clients’ financial trajectories. The impact goes beyond immediate financial relief; it accelerates the path toward wealth accumulation and long-term financial security. This, in turn, fosters a deeper level of trust, as clients recognize the value of your guidance not only in safeguarding their financial well-being but also in actively propelling them towards their financial aspirations. As you become a trusted ally on their financial journey, your competitive edge in the market becomes even more evident, establishing your practice as the go-to destination for those seeking a comprehensive, forward-thinking, and results-oriented financial advisory experience.

11. Get in with the Next Generation of Clients

Many advisors are looking for ways to engage with the next generation of clients, and debt management presents an accessible and effective entry point. Many of your clients’ children may be getting ready to go to college, buying their first car or opening up their first credit card. As an advisor, you can provide value early on to your client’s children by helping and teaching them how to manage debt effectively – allowing them to see you as a valuable part of their financial journey.

By actively engaging with the next generation and helping them navigate the complexities of debt, you establish yourself as a trusted mentor. Your early involvement in their financial lives positions you as a guiding force in building wealth sooner.

Moreover, this commitment to the financial success of the next generation fosters enduring client-advisor relationships. As these individuals accumulate wealth, they will no longer seek to change advisors because they will already recognize you as the guiding hand that has facilitated their path to achieving their financial objectives. By embracing debt management as a means of connecting with the next generation, you not only enrich their financial futures but also fortify the bonds of trust that lie at the heart of lasting advisory relationships.

Learn more about how to get in with the next generation of clients.

12. Support Clients with Debt Consolidation and Refinancing

Debt consolidation and refinancing are powerful tools at your disposal as an advisor. These strategies can help your clients reduce their interest rates and monthly payments, which, in turn, free up more funds for savings and investments. Be sure to analyze your client’s debt portfolio thoroughly to determine if consolidation or refinancing makes sense in their situation. Properly executed, these actions can make debt payments more manageable and cost-effective.

Debt consolidation and refinancing strategies are often most suitable for clients who have high-interest debt, multiple debt payments, have a sudden change in their financial situation, want to increase their credit score, or are seeking to accelerate debt payoff. As an advisor, you can use tools such as Optivice, to see exactly how much money you could save your clients through these strategies and how much quicker they would pay down their debt.

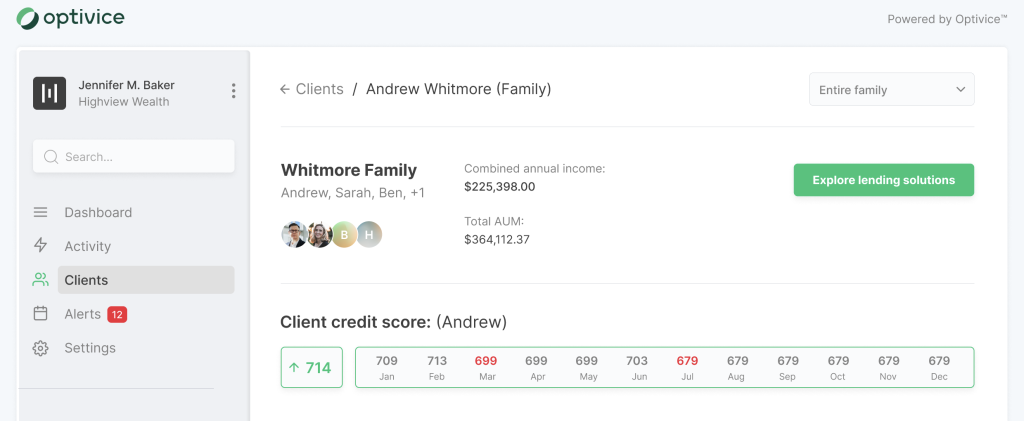

13. Increase their Credit Score and Financial Opportunities

By ensuring that clients properly manage their debt and credit, you can have a positive impact on their credit score, in turn, unlocking a world of expanded financial opportunities. Your client’s credit score influences various aspects of their financial lives, including mortgage and loan eligibility, access to lower interest rates, rental prospects, employment opportunities, insurance premiums, and optimal credit limits. Even if your clients have modest outstanding debts, it’s likely they possess a credit card or two. Assisting them in managing their credit wisely can open doors to a wider range of financial opportunities.

The role of a financial advisor extends far beyond numbers and investments; it encompasses the art of sculpting financial destinies. By championing effective debt and credit management, advisors are not just safeguarding their clients’ present financial well-being but also laying the foundation for their future financial success. It’s a commitment to realizing the full potential of each client’s financial journey and ensuring that every door of opportunity remains wide open.

Learn more about how to increase your client’s credit scores.

14. Provide Proper Risk Mitigation

Effective debt management plays a critical role in mitigating financial risk, particularly in the context of high-interest debt. High-interest obligations, such as credit card balances and loans with exorbitant interest rates, can significantly threaten an individual’s financial stability. Firstly, they expose borrowers to interest rate risk, as fluctuations in interest rates can increase the cost of servicing such debt, potentially straining their financial capacity. By actively working to reduce and eliminate high-interest debt, financial advisors help clients avoid the negative consequences of interest rate hikes.

Moreover, high-interest debt can exacerbate the impact of market volatility, a second key risk factor. During economic downturns or financial crises, individuals burdened with substantial debt obligations may find it challenging to weather the storm. Here, effective debt management becomes a protective shield, enabling clients to build a more resilient financial position and reducing their vulnerability to market fluctuations.

Additionally, high levels of debt force individuals to consider selling assets or liquidating investments during market downturns to meet their debt obligations, contributing to asset erosion. Financial advisors who guide clients in reducing debt provide them with greater financial flexibility. This reduced reliance on selling assets during turbulent market conditions can help safeguard their wealth and financial security, acting as a third layer of risk mitigation.

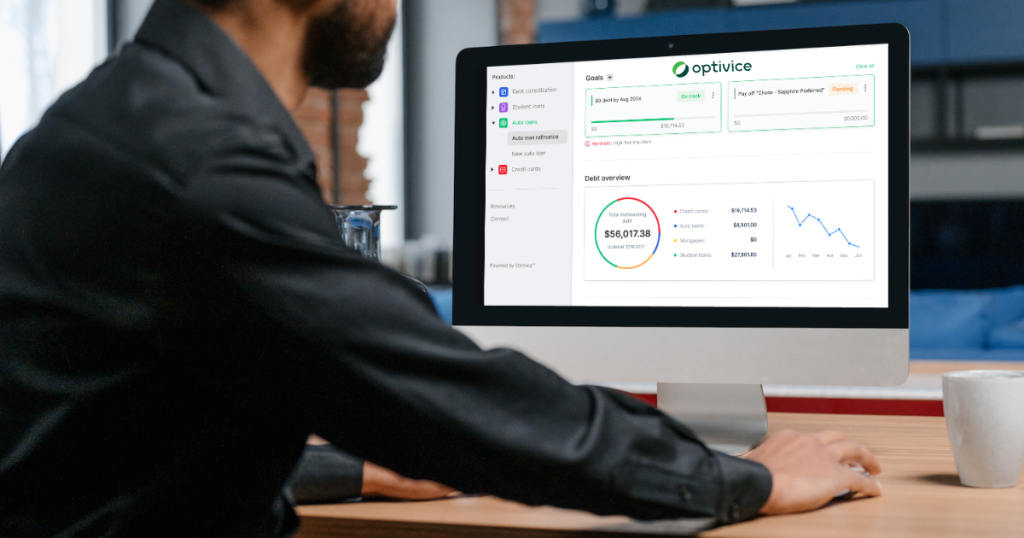

15. Technology Can Make you a Debt Management Expert

Providing debt management can be a daunting task, especially when it involves tracking down your clients’ latest credit card statements or continually requesting updates on their mortgage balances. Fortunately, the arrival of debt management technology Optivice has transformed the process into a seamlessly integrated component of holistic financial planning. Advisors can now gain access to a comprehensive and always up-to-date overview of their clients’ debts in seconds.

Optivice’s multifaceted capabilities extend beyond debt tracking. It empowers advisors to monitor credit score changes, track progress toward debt repayment goals, and proactively issue notifications with valuable insights on each client’s unique debt portfolio. This real-time visibility into your clients’ financial picture equips you with the information needed to make informed decisions and provide timely guidance, ensuring your clients’ financial well-being is always at the forefront of your advisory practice.

Optivice has the capability to visually illustrate the progress and profound positive impact that your debt management services are having in your clients’ financial lives. Whether it’s showcasing the considerable savings you’ve facilitated or the expedited pace at which debt is being paid down, Optivice transforms abstract financial strategies into tangible, motivating visuals. It’s a powerful tool in your arsenal, aligning your capabilities with your clients’ financial objectives and bringing your advisory services to life.

Learn more about how Optivice can help you integrate debt management into your practice

Takeaway

For financial advisors, embracing debt management is not just a strategic decision, but a commitment to empowering clients to achieve their financial goals and build a secure financial future. By offering this essential service, advisors not only strengthen their client relationships but also provide a more comprehensive approach to financial planning, setting them apart in a competitive market.

These 15 compelling reasons to embrace debt management are not mere bullet points but a roadmap to financial empowerment. They underscore the pivotal role that effective debt management plays in the lives of clients, enabling them to shed financial stress, accelerate progress toward their goals, and secure their financial future.

In conclusion, it is clear that debt management is not an optional extra but an indispensable cornerstone of modern financial advice. It ensures advisors remain at the forefront of their industry, adeptly meeting the evolving needs of both current and future generations of clients. By taking providing debt management, advisors not only enrich the lives of their clients but also elevate their own professional success and impact.

Photo credit: Investopedia/Nez Riaz[/caption]

Photo credit: Investopedia/Nez Riaz[/caption]