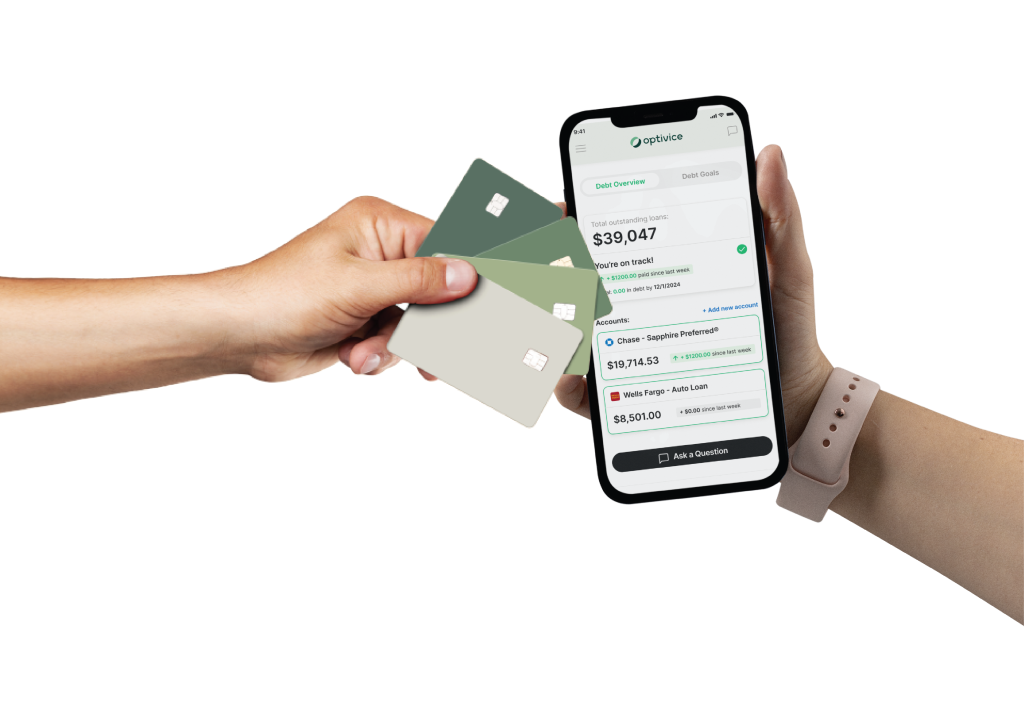

Offering debt management services can help you get new clients as a financial advisor by helping new clients quickly achieve financial stability. In addition, providing debt management services opens up new avenues of revenue for advisors. Providing debt management services is truly a win-win opportunity.

Regardless of your business model, integrating debt management services into your offerings can get you more clients and provide additional revenue streams. Whether through subscription-based pricing models, enticing add-ons, or asset management opportunities, financial advisors have the chance to attract new clients and optimize their earnings through debt management services.

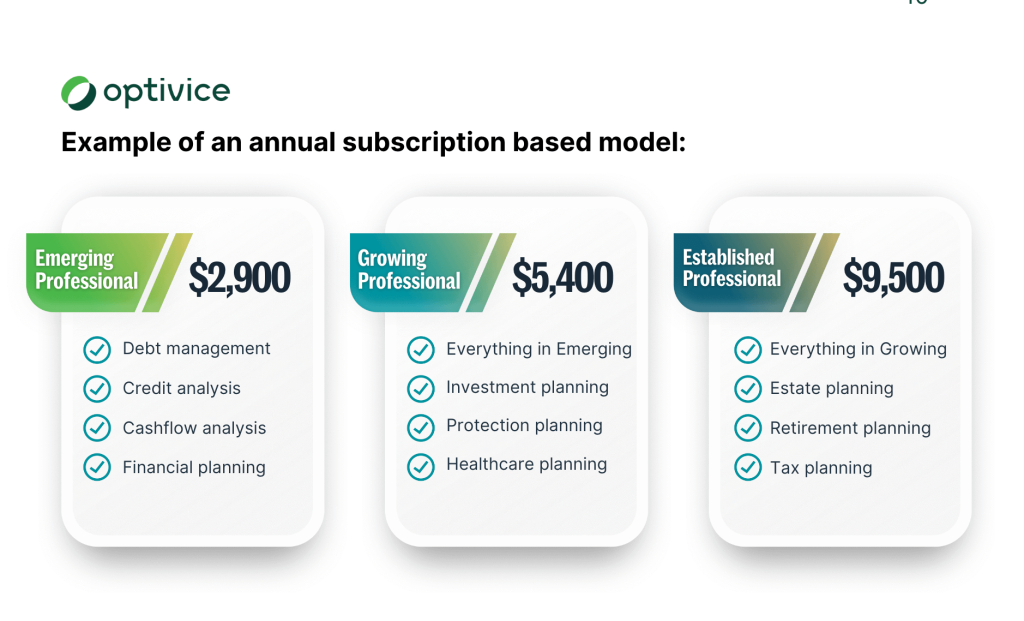

Get new clients with Subscription-based planning models

Financial advisors can incorporate debt management services into their subscription-based pricing models by including these services in their initial tier. Debt management services can act as a magnet to attract prospective clients with substantial income potential who are starting their financial journey. Once advisors guide clients to effectively manage debt, they can upgrade them to the next pricing tier, continuing with them along their financial journey as their wealth accumulates – transforming them into long-term clients with investable assets.

Get new clients with project-based planning

If only a specific set of prospects and clients need debt planning, then advisors can provide debt management services as an optional add-on or as specific project-based planning. For example, many high-income individuals, such as dentists, grapple with debt, making debt management an extremely attractive and valuable service. As a result, this service offering allows you to easily bring them on as clients to your advisory firm, provide them with valuable services, and retain them as life-long clients.

Get new clients with AUM based model

As advisors help clients progress in reducing their debt, they will also free up more funds available for investment. Advisors can seize this opportunity to oversee and manage these investments, earning more fees based on the assets under their management. For instance, Amy Schultz of Bolder Money said, “By providing compassionate, personalized financial guidance and accountability for our members, we’ve unlocked significant financial potential, and have transferred over $500K in AUM to financial advisors.”

This model also serves as an effective strategy for advisors to connect with the next generation of clients. By assisting their clients’ children in managing debt, advisors can offer value and establish relationships, thereby ensuring the family’s continued loyalty as clients for generations to come.

Increase revenue with a commission-based model

Financial advisors can provide substantial value to their clients by consolidating debt or refinancing loans. These strategies can save clients thousands of dollars in interest fees and simplify their debt repayments. As a result of seeing tangible benefits from their advisor, clients will refer their network.

Depending on the financial advisor firm’s business model, advisors have the opportunity to generate additional revenue by earning commissions through loan consolidation, issuance, and refinancing. Not only do advisors help clients save money, but they can also enhance their income.

Given that this model is often a subject of debate, at Optivice, we offer commissions as an optional source of income, allowing advisors to make decisions that align with their client’s best interests and their practice’s goals. We go the extra mile to ensure that advisors only recommend loans that are in their client’s best interest and maintain rigorous compliance tracking.

Final Thoughts

In conclusion, integrating debt management services into a financial advisory practice is a strategic move that benefits both advisors and their clients. It unlocks new revenue streams while helping clients achieve financial stability. This win-win opportunity can be implemented through various models, including subscription-based pricing, project-based planning, AUM-based models, and even commission-based approaches.

By providing these services, financial advisors not only attract new clients but also foster long-term relationships by guiding them along their financial journey. As clients reduce their debt and free up funds for investment, advisors can further optimize their earnings. Additionally, commission-based models, when executed with clients’ best interests in mind, can add value and income.

Ultimately, the key lies in offering compassionate, personalized financial guidance and maintaining a commitment to clients’ financial well-being. As financial advisors explore the potential of debt management services, they open up a world of growth opportunities, all while helping individuals navigate the often complex landscape of debt and finance.

Download Your Guide to Mastering Debt Management

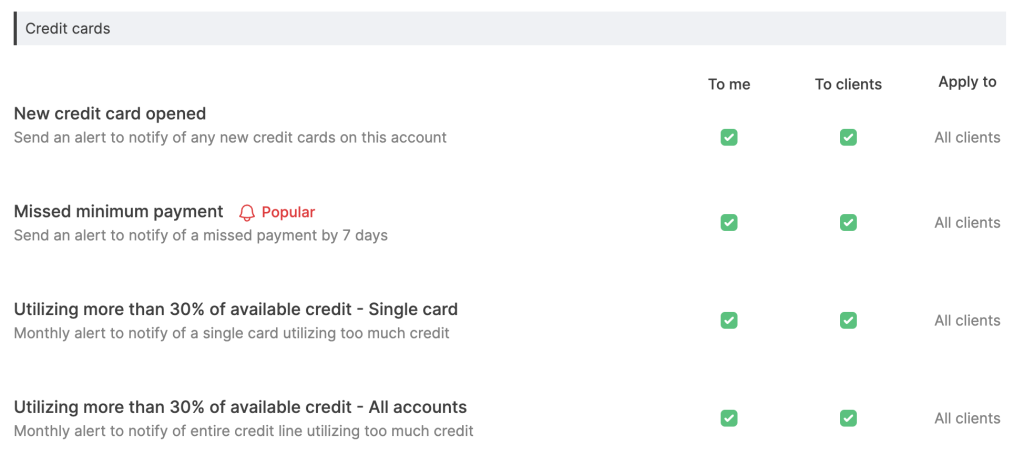

Credit Cards 101 – A Guide for Financial Advisors

This credit card guide will provide you with the tools to effectively advise your clients on how credit cards work, the different types of credit cards, responsible credit card usage, and more.

How to Unlock New Streams of Revenue and Get New Clients by Offering Debt Management

Integrating debt management services into a financial advisory practice is a strategic move that benefits both advisors and their clients.

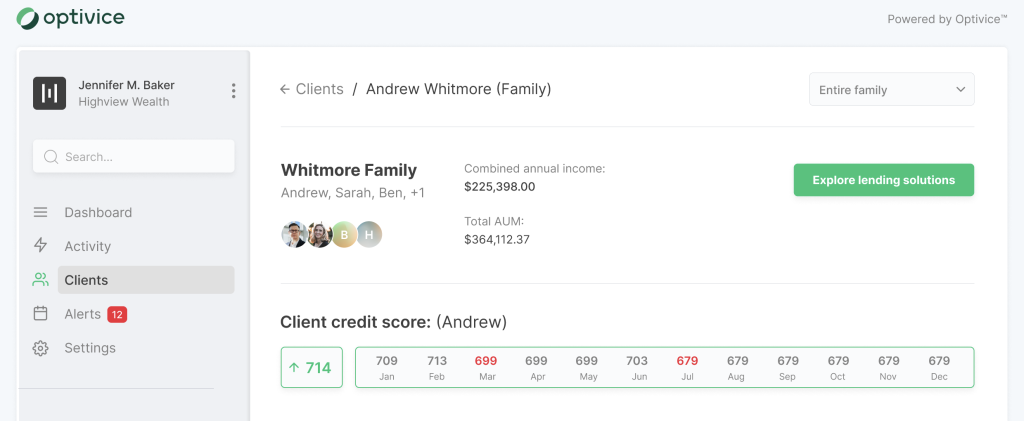

Advising High-Income Earners on Managing Debt

High-income individuals face unique challenges when managing their debt. As a financial advisor, using the right tools can help you provide better service.